Medicare Part D Penalties

Avoid Higher Costs with Medicare Part D Medicare Part D is a crucial coverage that provides prescription drug benefits through private insurance companies. Unless you have VA benefits, it's essential to enroll in Medicare Part D when you become eligible

Medicare Part B Penalties

Avoid Higher Costs with Medicare Part B Enrolling in Medicare after the age of 65 can lead to higher costs, including penalties for late enrollment. Let's explore how these penalties can apply to Medicare Part B and Medicare Part D

Medicare & Social Security Enrollments

Enrolling into Medicare & Social Security at the same time When it comes to taking retirement benefits from Social Security and Medicare, it may not always make sense to enroll in both benefits at the same time. Typically, individuals are

Medicare Saving Account Plans (MSA)

MSA - Medicare Savings Account When it comes to Medicare in Minnesota, there are over 400 plan combinations that an individual can have. Choices are great but shopping for coverage alone can quickly seem overwhelming. Medicare Savings Account (MSA) plans

Medicare Part D & the Donut Hole

Medicare Part D & the Donut Hole Medicare Part D may seem simple at the surface, but it can create surprises for some Medicare beneficiaries. There are features within this coverage that's unique to Medicare and can lead to higher

Why purchase insurance with my Original Medicare?

Why do I need to purchase insurance with Original Medicare? Medicare does not cover all your medical needs at 100% and does not cover everything. It also does not have a max out of pocket with your coverage and private

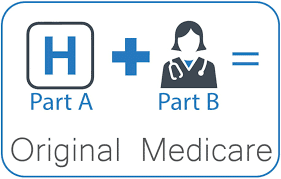

What does Original Medicare cover?

What does Original Medicare cover? Medicare can seem daunting at times and if you are approaching your 65th birthday, it can feel like you have a target on your back with all the solicitations that you are receiving from health

What should I consider when reviewing Medicare plans?

What should I consider when reviewing Medicare plans? Understanding the complexities of Medicare can be daunting and knowing when to start planning is crucial to avoid unnecessary costs. It is best to begin planning within six to twelve months of

Income & Medicare Premiums

IRMAA -for Medicare Beneficaries Medicare does not cost the same for everyone, and some individuals are subject to pay higher premiums due to their income. We will quickly break down what you need to know to avoid paying more for

Medicare & HSA

Medicare & HSA You made it! It may seem surreal that Medicare is finally approaching your doorstep and the discussions around the water cooler about Medicare with your colleagues are not getting you the answers you need. One thing to

How to Sign Up for Medicare

How to Sign Up for Medicare Signing up for Medicare is not the same process for everyone and acting at the right time for your situation could save you thousands of dollars over time in retirement. When the time comes,

Medicare & Enrollment Periods

Enrollment Periods with Medicare Medicare is not automatic for everyone; signing up just because you are 65 is not always the best strategy. We will break down enrollment periods with Medicare and share tips along the way. Initial Enrollment Period Your