- 952-222-2100

- Get Quote

What is MNsure

- Home

- What is MNsure

Options When Shopping for Health Insurance

Understanding health insurance can be overwhelming, like dealing with a constantly changing live animal. It has its own set of rules and a language that can be hard to grasp. In this blog, we aim to simplify MNsure and its significance for Minnesotans seeking health insurance.

Affordable Care Act (ACA)

The ACA became law in the spring of 2010, bringing numerous changes to coverage options and plan types. Minnesota and 14 other states have created a unique website to allow their residents to shop for health insurance options. Think of MNsure as a personalized platform where you can explore health insurance plans available in Minnesota. It’s also the only place where you can apply for financial assistance to reduce your monthly insurance premium and out-of-pocket costs.

What to expect when using MNsure

In Minnesota, there are currently four companies offering health insurance options on MNsure. While there may be more plan choices outside of this platform, only the plans listed on MNsure qualify for subsidies. Subsidies, also known as Premium Tax Credits, can help lower your health insurance costs. To apply for these credits, you need to provide your income information to MNsure when applying for financial assistance. MNsure will promptly notify you of the subsidy amount you qualify for.

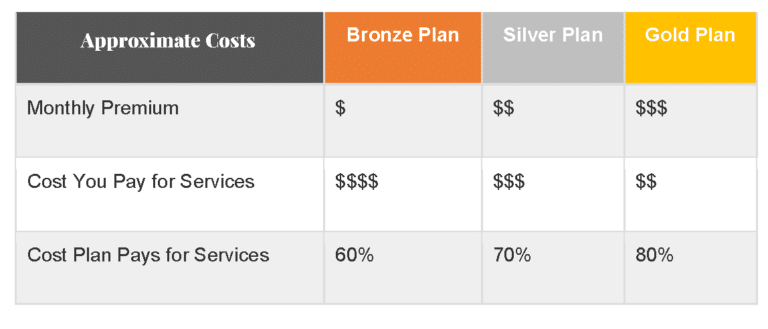

Once your information is shared, you can start shopping for plans! As you review the available options, you’ll notice that each company offers different levels of coverage. To make comparisons easier, the ACA has created categories represented by Olympic Medals. It’s important to note that these metal levels describe the deductible levels, not the quality of the plan or medical services you’ll receive. Let’s break them down:

Bronze

This is used to describe a plan that has the highest deductible, or out-of-pocket cost that you are needing to pay before the plan will start sharing the cost of your medical bills. This level typically has an option to fund HSA.

Silver

Is a deductible level that the government rates moderate or in the middle. Silver plans will typically have a higher monthly premium cost compared to Bronze plan options. Unlike Bronze plans, Silver plans will start sharing the cost of your medical bills sooner. This coverage level will typically have an option for HSA or copay like plans.

Gold

Just like winning a gold medal at the Olympics, this plan begins covering portions of your medical bills earlier than Bronze or Silver plans. However, it also comes with the highest premium costs due to its lower deductible. This coverage option typically offers copays for medications and doctor visits

If you’re already feeling overwhelmed by the terminology we’ve covered, you’re not alone. Schatz Benefit Group is a free resource that can guide you through each step. They provide education on how these concepts apply to your specific situation and assist you throughout the enrollment process, ensuring a smooth experience when selecting your coverage.